How To Make Money Writing Options

The Math Behind Making $100,000 Each Year Selling Options

![]()

I painstakingly crunched the numbers so you don't have to

Earlier last year, I did some calculations to determine what it would take to make $100,000 every year through dividend stocks.

While the feat unsurprisingly involved large sums of money, reinvesting the dividend, watching as the dividend grew each year, and continuing to invest into your portfolio sped up the process, it takes considerable time to make $100,000 every year through dividend investing.

Selling options on the other hand can be accelerated or decelerated at your pace. Rather than receiving a consistent dividend payment, you decide how much premium you want to collect each week.

Volatile stocks will provide you with higher premiums while reliable companies with low volatility won't provide high premiums.

If you want to make $100,000 every year selling options, you'd have to earn $1,923.08 in premiums every week.

While you'd still need a pretty penny to make $1,923.08 in premiums each week, you can make 6-figures with this strategy sooner than you would through dividend stocks.

The math to $100,000 each year depends on which stock or ETF you decide to trade options for, but for this example we'll focus on QQQ.

QQQ is an ETF that tracks the NASDAQ 100 index which means you'll want to pay extra attention to the tech sector.

The NASDAQ commonly outperforms the S&P 500 and Russell 2000, but it is also more volatile.

I prefer to sell options that expire at the end of each week, and it's a great way to make consistent income. Here is what QQQ's premiums look like on contracts set to expire in two days.

If you sell options on a Monday, you'll get higher premiums because there are more days until the contracts expire.

Let's say you want to keep your QQQ shares for as long as possible but you still want to collect premiums. In this case, I'd set a 269 strike price to earn a $104 premium right off the bat.

$269 is safe for me because QQQ would have to move up 1.8% in 2 days. Given how the market has been performing lately, I'm not holding my breath waiting for QQQ to reach $269. In fact, I wouldn't mind selling my shares at $269 per share.

A quick explanation on the numbers on this chart…

Yes, there are a ton of numbers on this chart. Just look at the 269 in the middle, look to the left where the calls are displayed, and you'll see a 1.04 under the bid category. This is how much you'd sell the contract for. The 1.09 represents how much you'd pay if you wanted to buy the call from someone.

Since options trade in multiples of 100 shares, the 1.04 represents how much you earn per share. Since we're talking in multiples of 100 shares, the premium for that call would be $104.

The earlier in the week you sell covered calls on QQQ, the more likely you are to earn $100 each week and keep your shares.

The catch is that in order to sell a covered call, you'd need 100 shares of QQQ. Since QQQ last traded for $264.16/share, you'd need $26416 invested in QQQ.

To make $1,923.08 each week, you'd need to sell roughly 19 covered calls which means you'll need 1,900 shares of QQQ.

Since QQQ last traded for $264.16/share, you'd need $501,904 invested in QQQ to make 6-figures by selling covered calls.

If you have the $500K, you're already set. While it may sound like a lot, you need a lot more money to achieve the same goal through dividend investing.

$500K invested in dividend stocks with a slightly above average 4% dividend yield would produce $20,000 each year. It's not bad, but it's still a far cry from 6-figures.

Let's walk through a few scenarios…

If you only have 100 shares of QQQ and make $104 each week, it would take you 254 weeks (almost 5 years) to get another 100 shares of QQQ just from the premiums.

If you have 500 shares of QQQ, it will take less than a year to get a free 100 QQQ shares through the premiums.

This strategy compounds.

Another scenario is to set a lower strike price such as $268 and receive a weekly $134 premium based on the graphic.

$134/week rather than $104/week speeds up the process. Instead of needing 1,900 QQQ shares, you'd only need 1,500 QQQ shares to pull off a 6-figure income.

You would then only need $396,240 to buy the 1,500 QQQ shares at their current price.

The premiums you collect from 100 QQQ shares would turn into an additional 100 shares a year earlier.

The premiums you collect from 500 QQQ shares would turn into an additional 100 shares in about 9 months instead of in practically 1 year (50.8 weeks using the $104 weekly premium).

You can sell covered calls on growth stocks like Fastly which promise higher premiums but come at greater risk. Not only can the stock move further down than your typical stock, but it can also skyrocket on a whim and blast beyond your strike price.

You can buy 100 shares of several of these types of stocks. You won't need to put as much money down as $396,240 in our previous example. At this point, the amount of money required would heavily depend on which stocks you pick and what their premiums are.

What Happens If You're Forced To Sell

Eventually, you'll get forced to sell shares in multiples of 100. This might not be a bad thing as you could exit at the right time.

You can also make additional income through cash secured puts. Not only is this a great way to make additional income, but you can get paid for being willing to buy stocks you want at more attractive price points.

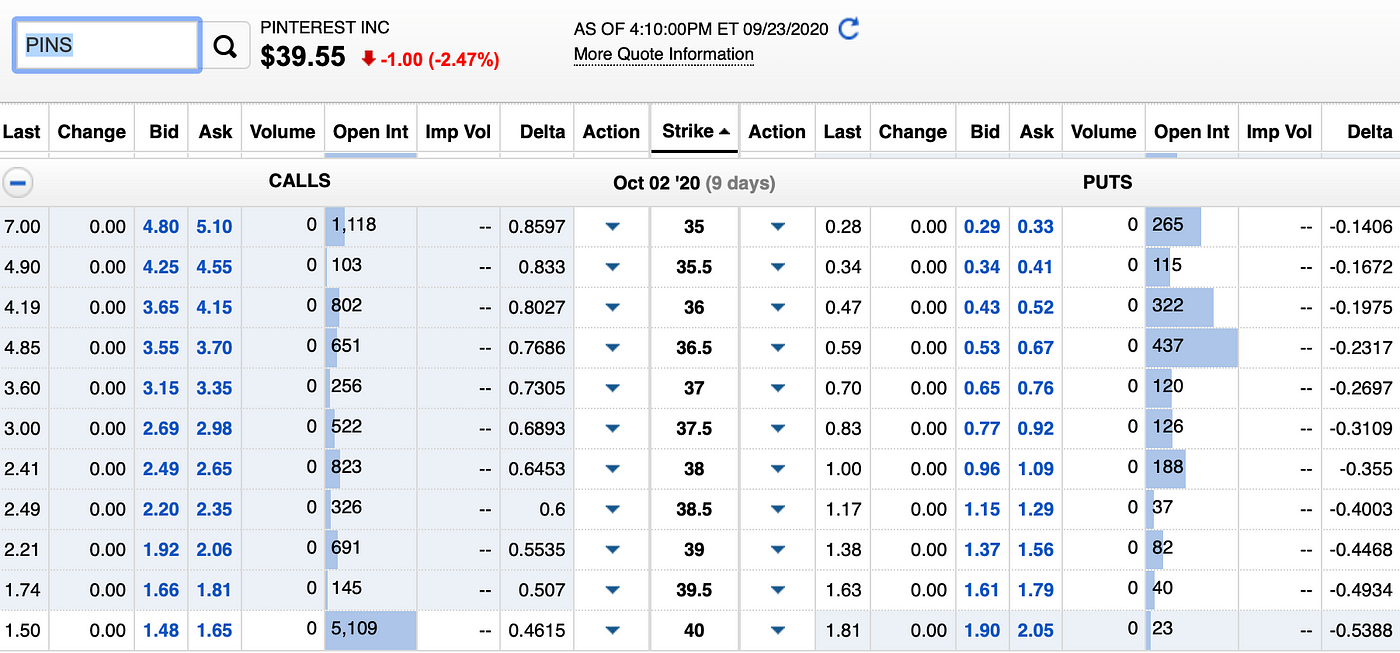

Let's look at Pinterest stock as an example.

For Pinterest, I chose to focus on the put options (numbers on the right) that expire in 9 days. Far out of the money put contracts expiring in 2 days have minuscule premiums that aren't worth mentioning.

I could effectively pay myself $29 to buy 100 shares of Pinterest at $35/share. I am perfectly fine with buying those shares, and if I don't get them before the contract expires, I'm still sitting on a 0.8% gain for that week and $3,529 in cash.

For a cash secured put, you don't have to buy the 100 shares. You just put the money down. At the contract's expiration, you'll either get the 100 shares or you will get all of your money back plus the premium.

This is also the best way to buy stocks. I detailed in an earlier article how Warren Buffett used this exact strategy to make $7.5 million in under 5 minutes.

If you end up having to sell 100 shares of QQQ at 265, you can keep buying cash secured puts with a strike price of 260 to collect a premium and end up with the same shares at a $5/share discount.

The only risk is that QQQ continues to rise and goes well above your strike price for the cash secured puts. That's why I prefer to sell contracts that expire by the end of the week because you usually don't see dramatic movement in a single week barring a big earnings report or an event.

Those two circumstances are more prevalent for companies rather than ETFs, but if a few heavily weighted NASDAQ companies report earnings at the same time (I'm looking at FAANG and Microsoft), it will make the index extra volatile that week.

Conclusion

Selling options is a great way to make extra money with a quicker path to 6-figures than dividend investing. Even if you aren't in the position to make 6-figures, you can quickly put yourself in a position to make an extra $100 or even $1,000 each month selling options.

Each week, your earnings will compound. Over time, you too can start earning 6-figures from selling options without needing a million dollar portfolio.

UPDATE: I only recommend this strategy with covered calls and cash secured puts. If you sell uncovered calls and puts, you expose yourself to the potential for massive losses. Covered calls and cash secured puts protect you from the massive loss scenario associated with uncovered positions.

In the article, I also imply that you can set the lower strike price to collect a higher premium. While this is true, it also increases the chances of the shares getting called away from you. If the stock suddenly moves well past the strike price, you could miss out on extra stock price appreciation.

An 8–10% annual return is possible with a less risky version of this strategy which implies you need $1M or slightly less than that to make 6-figures with this strategy.

The 20% annual return scenario is also possible but it takes on some additional risk and you could leave money on the table due to stock appreciation in the case of a covered call or depreciation in the case of a cash secured put.

To get a better understanding of the risks with options, consider reading this article:

It's hard to understand options unless you give them a try. I recommend starting by selling a covered, extremely out of the money call that expires in 1 day on a low volatility stock to get started. You won't make much from that 1 covered option, but it will give you a better idea of the risks and rewards for this strategy.

Want to learn more about stock investing? Make sure you subscribe to Beat The Market on YouTube

Gain Access to Expert View — Subscribe to DDI Intel

How To Make Money Writing Options

Source: https://medium.datadriveninvestor.com/the-math-behind-making-100-000-each-year-selling-options-a399866d16fb

Posted by: thompsonandesch.blogspot.com

0 Response to "How To Make Money Writing Options"

Post a Comment